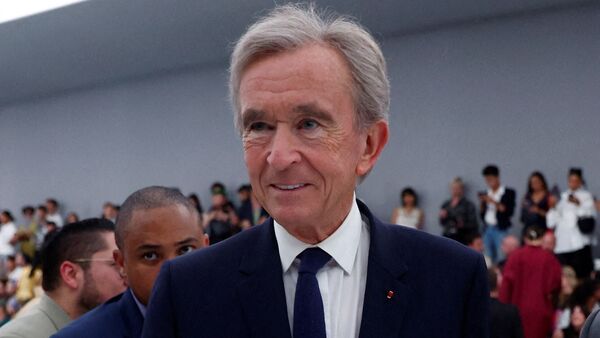

Back in January, Bernard Arnault, founder and CEO of LVMH, said he would be perfectly happy with 8%-10% sales growth for the group’s fashion and leather goods division this year. Expansion at that level now looks like wishful thinking. The unit, led by Louis Vuitton and Dior, just delivered a 2% increase in organic sales, its lowest growth since 2016 (excluding the pandemic-induced contraction).

Given that luxury is coming off of three blockbuster years, the outcome wasn’t as bad as it could have been. But if the world’s biggest luxury group is battling to lift sales, then the struggle will be even more pronounced for most of the rest of the top-end industry.

LVMH said group sales excluding currency movements and mergers and acquisitions rose 3% in the three months to 31 March, broadly in line with the expectations of analysts.

This first quarter was always going to be tricky. In the corresponding three months of 2023, China had just lifted its covid restrictions and consumers there rushed to stock up on high-end goods. The US and Europe, while showing some cracks, were still satisfactory.

Sales of fashion and leather goods to mainland Chinese consumers at home and abroad rose almost 10% in the first quarter of 2024, with a particular shift to Japan, where the weak yen made products more affordable to buy there than at home. This was a decent performance, driven by both VIP and middle-class consumers, and helps assuage fears that affluent shoppers were suffering disproportionately, as they were in the US and Europe. Even so, it’s still not yet clear that Chinese consumers can pick up the bling baton from their western counterparts.

Aspirational shoppers in the US remain under pressure from inflation. Although there had been a gradual improvement over the past three quarters in demand for fashion and leather goods from this cohort, LVMH expects these customers to only slowly regain their purchasing power.

The wines and spirits division saw organic sales fall 12%—it was hurt by retailers in the US taking a cautious attitude to restocking cognac as Americans retrenched from pricy drinks—and a subdued Chinese New Year.

Nevertheless, this is a far cry from Kering’s profit warning last month. It underlines that LVMH should be able to navigate a decelerating luxury market better than most.

This is because it owns the industry’s biggest brand, Louis Vuitton, and Dior. Even if some of the shine has come off of these houses—Louis Vuitton expanded slightly above the average for the fashion and leather goods division in the first quarter, while Dior was slightly below—LVMH’s scale means it can shout louder than rivals. This ensures its brands remain at the forefront of consumers’ minds.

It also owns Sephora, the retailer whose biggest market is the US, and which is not sharing Ulta Beauty’s view that consumers are losing their appetite for perfume and cosmetics.

All this will put LVMH in the stronger-performing camp—but it probably won’t lead the pack. That prize will most likely belong to Hermes, which is still expected to generate organic sales growth in a double-digit percentage. Richemont should also benefit from top-end buyers shifting from handbags to Cartier jewellery, but the watch market is more challenging. The picture is less rosy for Kering, which is struggling to rejuvenate Gucci. Similarly, Burberry is trying to implement a change of creative direction while at the same time taking the brand upmarket.

The more than 20% increase in LVMH shares between mid-January—just before Arnault reassured investors that demand was gradually decelerating rather than falling off a cliff—and Tuesday’s close looks optimistic. The shares rose another 3% on Wednesday morning.

The first half of this year should be the nadir for luxury demand. Investors are looking for an inflection point in the US market, while any improvement in outbound Chinese tourism to Europe would be helpful.

Stock markets remain close to record highs, while Bitcoin is still elevated though down from March’s record. Secondary watch prices are stabilizing, too, and that’s perhaps a leading indicator for the sector. Plus, comparisons with the second half of 2023 should be easier.

For now, these positives remain some way off. Investors seized on Arnault’s comments in January that the industry was heading for a soft landing, and have taken LVMH’s performance as a sign of stabilization, not a severe slump. But this outcome is still far from certain. ©bloomberg