Already this year, billionaire retail mogul Jeff Sutton has sold four prime retail properties for just under $2 billion.

Famously reclusive, Sutton (who declined to be interviewed by The Post for this story), the founder of Wharton Properties, is perhaps the city’s most powerful investor in retail buildings in Manhattan with roughly 120 properties. For decades, he had been a net buyer and rarely a seller.

Now, he’s making moves.

After a whirlwind visit to Italy earlier this year, Sutton closed a deal with Italian fashion powerhouse Prada in 19 days with a handshake and a transfer of funds. Then he closed a deal in a similar fashion with French rival Kering in 28 days. There were no contracts, no deposits and the deals went straight to closing.

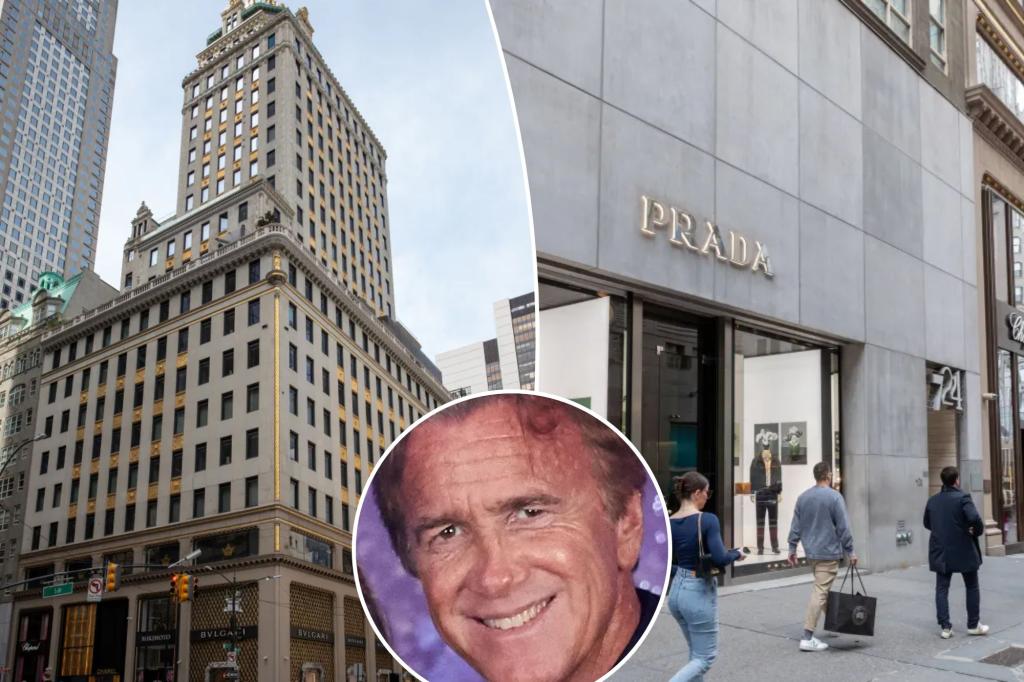

At the finish line, Paris-based Kering, the parent company of Gucci and Saint Laurent, paid $963 million for 115,000 square feet in the base of 717 Fifth Ave., while Prada bought both 720 Fifth and the adjacent building that held its store and offices at 724 Fifth Ave. for $835 million, mere months after Sutton sold the retail space at 747 Madison to Dyson for $135 million.

Sutton’s strategy through the years was to control the supply of the “micro markets” within the top retail streets, to shift the supply-and-demand curve towards the owners. As an example of this, he purchased three of the eight coveted corners along Fifth Avenue, between 56th and 57th streets: 720 Fifth, the Crown Building at 730 Fifth and 717 Fifth.

Four of the other corners were already owned by their tenants: Bergdorf Goodman, Tiffany, Louis Vuitton and Harry Winston. The other non-Sutton corner was on a long-term lease to Kering’s brand, Gucci, at Trump Tower at 725 Fifth Ave.

In 2016, Sutton rented one of his Crown Building corners at West 57th Street to Bulgari for a whopping rent of $5,500 per foot, reinforcing his belief that controlling a scarce commodity would eventually pay big dividends. But looking into the future, Sutton sold floors four through 26 in the Crown Building to billionaire Vlad Doronin who would transform it into the luxurious Aman Hotel and Residences there.

The Post discovered that was because Sutton had been planning to redevelop his two adjacent Fifth Avenue buildings at 720 and 724 into a luxury tower designed by Bjarke Ingels with Central Park views that would use the Aman name and amenities. Those plans are now unlikely to be realized.

All of these deals represent a solution to high mortgage interest rates, weakened capital markets that impeded the refinancing of maturing mortgages and property taxes that can be as high as retail rents themselves. Sutton’s plan was to target well-capitalized, European retailers and fashion houses that enjoyed lower interest rates on their continent and would have protection from spiraling real estate taxes as Big Apple owner occupiers.

“There was seismic news: Jeff Sutton pulled off not one, but two amazing deals.”

Marc Holliday, CEO of SL Green

The first deal of this kind had its roots on Madison Avenue. In 2011 Sutton and SL Green purchased the retail at 747 Madison for $66 million. He split the original Valentino store into two spaces, which were quickly rented to Givenchy and Alexander McQueen at record rents. Two years later, Sutton bought out SL Green and eventually replaced Givenchy with Versace.

In March 2023, the British vacuum king John Dyson’s family office purchased 155 Mercer St. for $60 million to open a store. Hearing of the deal, sources say Sutton moved quickly, selling Dyson 747 Madison for $135 million.

That sale made Sutton confident that his European owner-user-buyer idea was doable. Industry sources say Sutton soon met with multiple brands in several European cities last year, culminating with the action-packed, back-to-back meetings in early December.

Sutton’s first meeting in Milan, sources said, was with Prada, which saw that it was now or never. Later that day, when he met with Kering, that company jumped when they realized there was only one corner left.

“There was seismic news,” said Marc Holliday, CEO of SL Green. “Jeff Sutton pulled off not one, but two amazing deals.”